Patrick Debattista

On 19th September, the S&P 500 notched its 39th record high in 2024.

While markets have been choppier of late, Wall Street kept defying expectations and delivering above-average stock market growth, especially compared to its peers across the Atlantic.

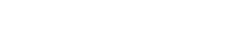

In fact, Figure 1 below shows that, if you invested €10,000 in the American S&P 500 30 years ago, today you would have almost triple the amount of capital than if you invested in the STOXX Europe 600 index.

This represents an 11.1% average annualised return for the S&P 500 over the past 20 years versus 6.9% for the STOXX Europe 600.

A culture of stock ownership

Besides the outperformance of the US stock market over its peers in the developed world, there is a culture of stock ownership in the US that does not seem to exist here in Europe.

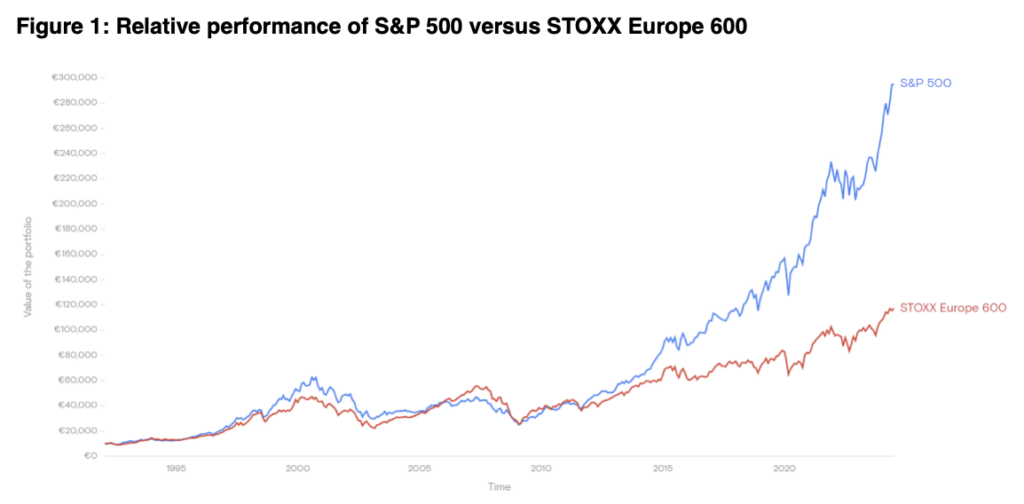

For example, U.S. households now hold an average of 42% of their total financial assets in stocks (Figure 2).

On the back of this investing culture and the success of the stock market, American private pension plans (loosely known as “401k’s”) worth at least $1 million have grown by 31% from the previous year.

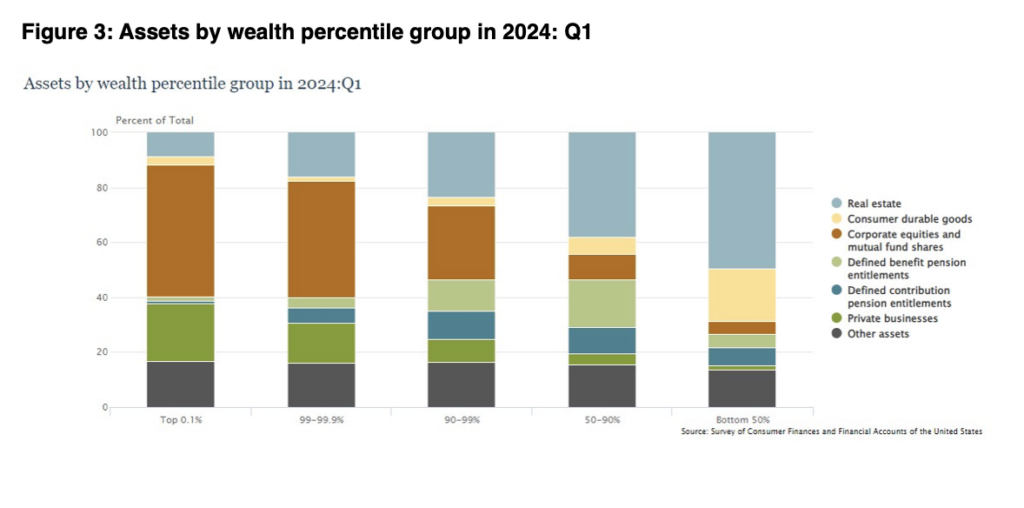

A deeper look into the figures shows that the most affluent 10% percentile of US households owned more than half of their wealth in equities, funds and private pension plans (Figure 3).

The proportions decline the less affluent the household, with the 50-90% percentile owning almost 40% of their wealth in these assets and the bottom 50% holding around 17%.

But the point remains. The average American investor has been indoctrinated to invest in American stocks.

This has arguably created a virtuous cycle of investment and growth in the US stock market over many years, which has fuelled further investment and growth in corporate America.

How does Malta compare?

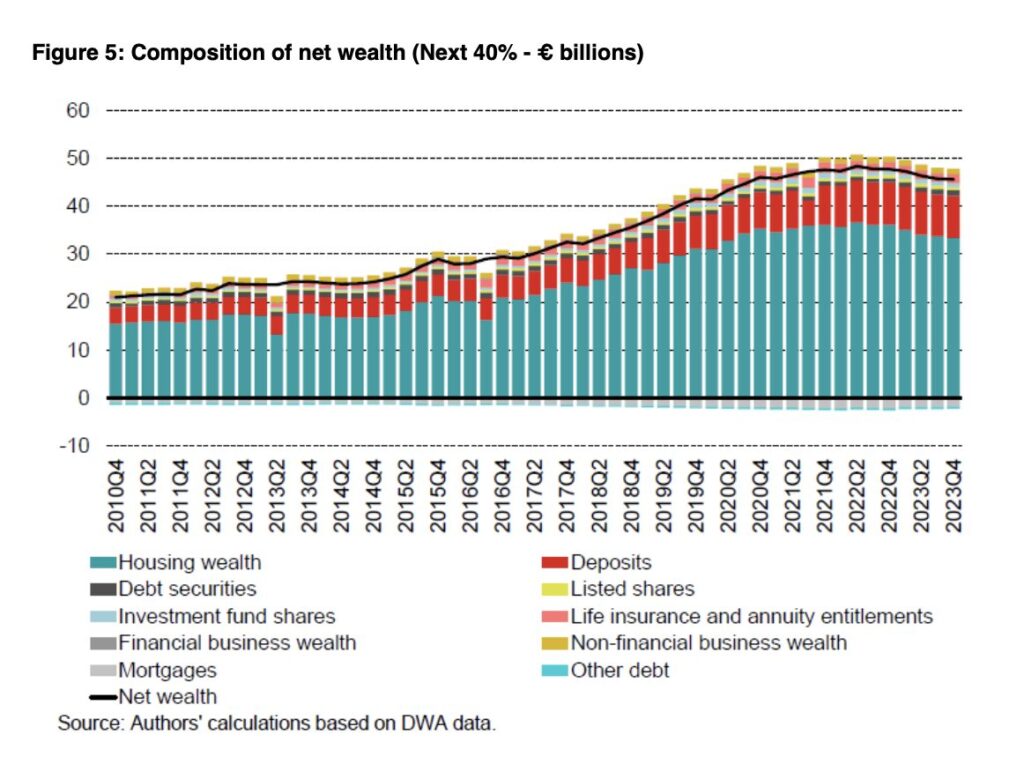

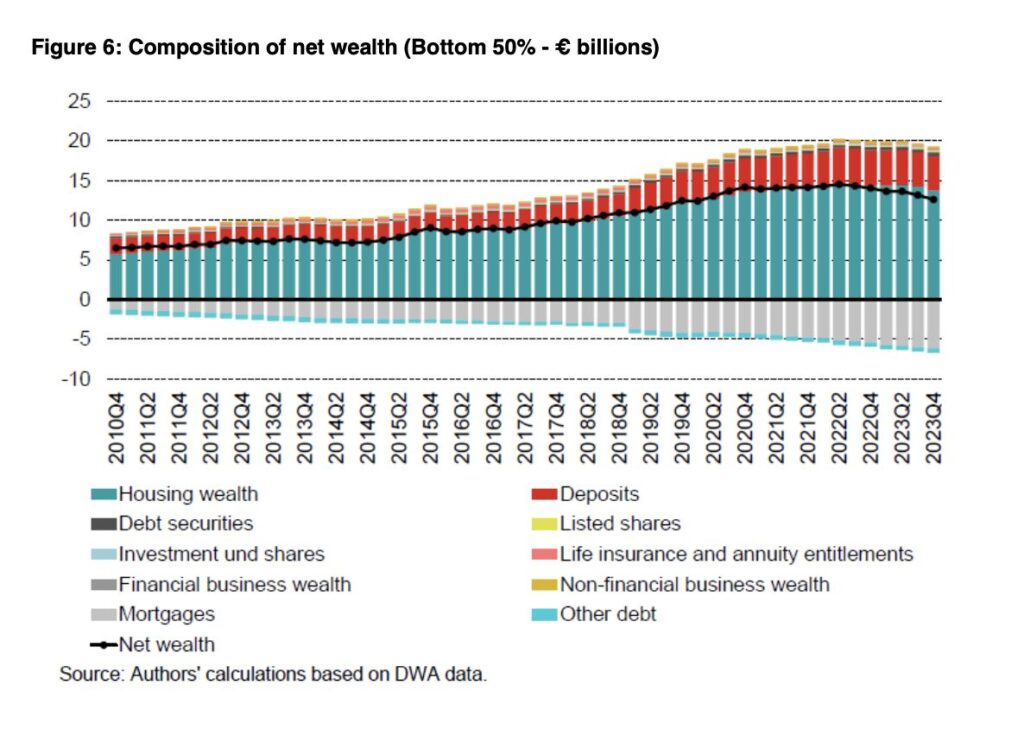

A recent report by the Central Bank of Malta sheds light on the composition of Maltese residents’ net wealth (Figures 4 to 6).

The results make for sobering reading:

- Housing wealth is by far the dominant asset class across all groups: 71.2% of total wealth for households in the bottom half, down to 50.4% for the top 10%.

- All cross-sections of society own negligible proportions of their net wealth in investment funds (the barely visible light blue bar).

- Households own even fewer listed shares (the light yellow bar).

- Moreover, bank deposits account for over 20% of the assets of households in the bottom half of the wealth distribution, and around 14% of total assets of the top decile.

Conclusion

All this adds fuel to the thesis that Maltese households are good savers, but poor investors.

The Maltese population continues to rely heavily on real estate and bank deposits to fund their and their children’s futures.

The question is: Are we missing out on the potential wealth creation opportunities and downside protection that more diversified investments could offer?

What will happen if the property market slows down or liquidity dries up?

Should we do better as a society to educate people on the benefits of owning stocks, bonds, funds and other diversified instruments?

I think “better” is an under-statement.

Disclaimer: No part of this article shall be construed as investment or financial advice, nor does it offer any promise, guarantee or prediction. The purpose of this article is purely educational and all opinions are the author’s. Investing has various risks and it is important you consider these, do your own research and consult a professional who would guide you on what is best for you.

You Might Also Like

Latest Article

MUT And ITS Secure New Collective Agreement For Academic Staff

The Institute of Tourism Studies (ITS) and the Malta Union of Teachers (MUT) have signed a new collective agreement that significantly improves conditions for academic staff at the institute. The agreement, signed on Friday in the presence of Deputy Prime Minister and Minister for Foreign Affairs and Tourism Ian Borg, introduces a number of … Continued

|

30 June 2025

Written by MeetInc.

May Unemployment Down By 14% Year-on-Year, Now At 1,050

|

30 June 2025

Written by MeetInc.

S&P 500, Nasdaq Hit New Highs As Market Rebound Completes

|

30 June 2025

Written by MeetInc.