Yannick Pace

Where did Jeffrey Epstein’s money come from — and where is it now? Years after his death, those questions remain at the centre of one of the most disturbing and unresolved financial stories of the past decade. His estate is still sitting on an estimated $150 to 200 million. One investment alone, a stake in a venture capital firm co-founded by billionaire Peter Thiel, has ballooned to nearly $200 million. Most of it will never reach his victims.

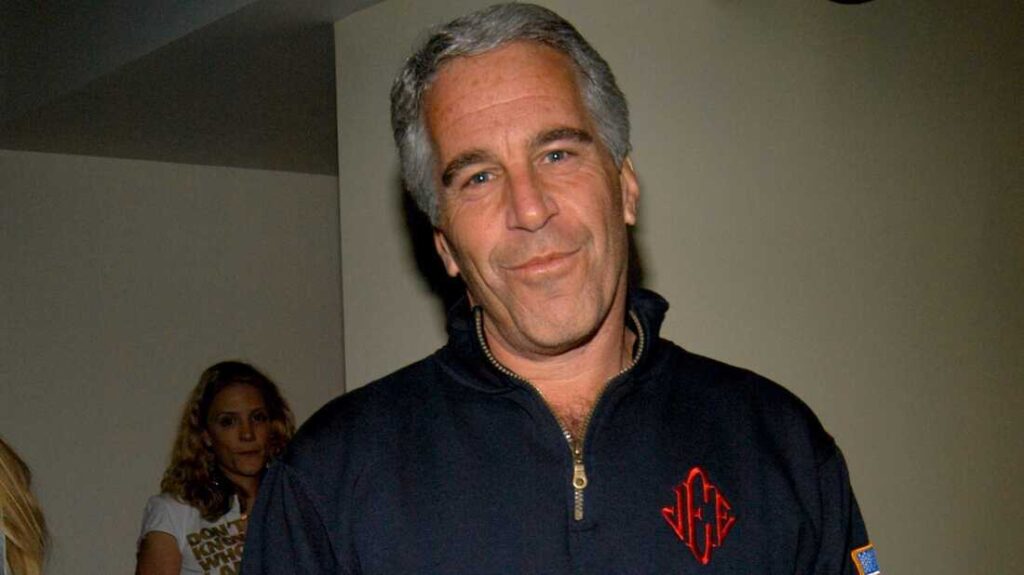

For someone who claimed to manage billions, Epstein left behind surprisingly few traces. His firm produced no public client list, and many of the billionaires he worked with now insist he was either overpaid or outright abusive with their money. Others, like Victoria’s Secret mogul Les Wexner and Apollo’s Leon Black, later accused him of misappropriation. What’s clear is that Epstein was a financial outlier. He was not a conventional asset manager. He was a fixer, a gatekeeper and, according to those who knew him, a man with access — the kind that doesn’t show up on balance sheets.

Before any of that, Epstein was a college dropout who lied his way into a job teaching mathematics at an elite private school in New York. Despite lacking a degree, he taught at the Dalton School, where he impressed wealthy parents and students alike with his charm and apparent intellect. One of those connections helped him land a junior position at Bear Stearns, a Wall Street firm where he quickly rose through the ranks. By the early 1980s, Epstein had left to start his own financial consulting firm, claiming to advise billionaires on tax strategy and estate planning. His exact client list was never made public, but his name began to circulate in elite financial circles. Colleagues described him as brilliant but untrustworthy, persuasive but manipulative. One former associate said Epstein was “a con man in a banker’s suit.”

Some of those connections are now facing renewed scrutiny. Earlier this year, it emerged that Epstein had invested $40 million into Valar Ventures, a fintech-focused investment firm co-founded by Peter Thiel. That investment, made in 2015 and 2016, is now worth roughly $170 to 200 million. It’s the single largest asset still held by Epstein’s estate. Thiel has not publicly commented on the matter, and there’s no indication he was aware of Epstein’s crimes, but the link has reignited interest in who benefited from Epstein’s financial clout long after his first conviction in 2008.

For victims, the news is hard to stomach. Many accepted settlements of $500,000 to $2 million, signing waivers that prevent them from pursuing further claims. Most of Epstein’s estate has already been paid out — including hundreds of millions in compensation, legal fees and taxes — but the remaining money, including the Valar stake, is locked into a secretive trust. Its known beneficiaries are Epstein’s former girlfriend Karyna Shuliak and two long-time advisers, Darren Indyke and Richard Kahn. The victims are, once again, out of reach.

Two days before his death in August 2019, Epstein quietly signed a document transferring all of his assets into a private entity known as the 1953 Trust. The trust, named after the year of his birth, has never been made public. Its contents and instructions remain sealed, and because it is a private legal instrument, the beneficiaries — and the final distribution of assets — are shielded from public scrutiny. This last-minute transfer has been widely criticised by lawyers representing victims, who see it as a calculated move to prevent further claims and obscure accountability.

At the time of his death, Epstein’s declared net worth was around $600 million. That included a sprawling collection of assets: his infamous Manhattan townhouse, once valued at over $70 million; a mansion in Palm Beach; a private island in the US Virgin Islands called Little Saint James; another island, Great Saint James, which was still under development; a ranch in New Mexico; an apartment in Paris; and a fleet of vehicles and private aircraft, including his widely reported Boeing 727. Several of these assets have since been sold to fund settlements and legal costs. The Manhattan townhouse and the Palm Beach mansion were sold within the first few years after his death. Little Saint James was also sold, reportedly to a tech entrepreneur, though the terms remain private. However, the exact status of other holdings, including the ranch and Great Saint James, is unclear. Estate filings suggest that not all properties have been liquidated. Some may still be held in trusts, or in entities tied to Epstein’s opaque network of offshore structures.

The New York Times first reported last week that eight former Dalton students said the way Jeffrey Epstein interacted with teenage girls had stuck with them since high school. Last week, Epstein was charged with sex trafficking of minors.

That outcome has been enabled by a failure of will at the federal level. After Epstein’s death in 2019, prosecutors considered using civil forfeiture to seize the remaining assets. They chose not to. Their reasoning, reportedly, was that doing so might delay payments to victims. Lawyers representing survivors have since said the government simply gave up. In the words of attorney David Boies, who led multiple lawsuits on behalf of Epstein’s victims, the state was “asleep at the switch.”

Meanwhile, what was once treated as conspiracy is becoming harder to ignore. The Department of Justice recently claimed to have released the full security footage from Epstein’s jail cell on the night of his death. But that footage contains a three-minute gap. No explanation has been offered for the missing segment, despite repeated questions. That detail alone has recharged suspicions that Epstein’s reach — and the network of people around him — may still be protected.

The panic around the story has also reached Trump’s camp. The former president once publicly pledged to release Epstein’s so-called client list. He has since walked that back, fuelling anger and distrust inside his own base. Online, speculation is mounting that Trump may be implicated in upcoming stories. Some of his advisers are reportedly scrambling to limit fallout. Whether that’s political theatre or something more serious, the timing is notable. A man who once distanced himself from Epstein is now facing pressure to explain exactly what he knew — and when.

There are still pieces of the Epstein puzzle that haven’t surfaced. The trust remains sealed. Some loans issued by the estate have been quietly forgiven. According to confidential court documents, at least $19 million in loans appear to have been cancelled, including loans made to entities closely associated with the estate’s executors. And despite the legal victories scored against Ghislaine Maxwell, many believe the full story has never come out.

What is certain is that Epstein’s money is still working. Locked in venture capital and protected by legal instruments, his fortune has not disappeared. It has simply moved out of sight — just like so many of the answers.

You Might Also Like

Latest Article

Bank Of Valletta Strengthens USD Clearing Access With New BNY Mellon Partnership

Bank of Valletta (BOV) has entered a new correspondent banking relationship with The Bank of New York Mellon (BNY), a move that broadens the bank’s international payment capabilities and strengthens its position in the global financial system. The agreement gives BOV customers enhanced access to U.S. Dollar cash clearing, complementing its existing relationship with Citibank. … Continued

|

5 September 2025

Written by Hailey Borg

Tesla Offers Elon Musk Record $1 Trillion Pay Package Tied To Ambitious Growth Targets

|

5 September 2025

Written by Hailey Borg

OpenAI Takes On Nvidia With Its Own AI Chips Built With Broadcom

|

5 September 2025

Written by Hailey Borg