HSBC Bank Malta p.l.c. delivered a strong performance in the first half of 2025, reporting a profit before tax of €58.7 million despite pressure from lower interest rates and a reduction in credit loss recoveries compared to the same period last year. The bank announced it will maintain its interim gross dividend at 10 cents per share, unchanged from 1H 2024, backed by its robust capital base.

The results reflect the bank’s resilience, with return on equity standing at 12.7% for the six months ended 30 June 2025. HSBC Malta continues to hold a strong balance sheet, with a Liquidity Coverage Ratio of 537% and a Tier 1 capital ratio of 22.5%, both comfortably above regulatory requirements.

Revenue Down but Non-Interest Income Grows

Total revenue for the first half fell by €13.6 million, or 11%, to €108.3 million as net interest income was impacted by the sustained decline in interest rates since June 2024. Net interest income dropped by €16.8 million to €89.8 million compared with the first half of 2024.

Non-funds income, which includes fees, commissions and trading income, improved by €0.5 million. The bank highlighted stronger results from transactional banking, foreign exchange sales and the issuance of domestic and international guarantees, with totals up 9% on the prior year. Wealth management also performed steadily, with assets under distribution up 4% in the first six months despite volatile markets.

Costs Rise on Investment and Regulation

Operating expenses increased by €2.3 million to €58.4 million compared with the same period in 2024, driven by higher staff costs, investment in technology and the implementation of regulatory projects. Costs related to HSBC Group’s strategic review were reimbursed.

The bank recorded a €3.0 million net release of expected credit losses (ECL), compared with a €7.0 million release in 1H 2024. The retail business accounted for a €3.3 million release as the bank reassessed mortgage loss parameters, partly offset by a €0.3 million charge in the commercial business.

Customer Deposits Grow, Loan Balances Decline

Customer deposits increased by €45 million to €6,203 million as at 30 June 2025, reflecting 2% growth in retail balances. Average commercial deposits were also higher than in the first half of 2024.

Net loans and advances to customers decreased by €82 million, or 3%, to €2,791 million compared with 31 December 2024. New retail lending sales improved over the same period last year, mainly driven by secured lending.

HSBC Malta’s investment portfolio rose by €197 million to €2,488 million as the bank continued to invest in highly rated securities to mitigate interest rate risk.

Subsidiary and Insurance Businesses Perform Strongly

HSBC Life Assurance (Malta) Ltd posted a profit of €6.5 million, up from €4.5 million last year, supported by an improved yield curve. Its solvency ratio stood at 247% at the end of June.

The bank’s asset management arm recorded a 31% increase in profit before tax, driven by higher net revenue and lower costs.

Outlook

Chief Executive Officer Geoffrey Fichte said the results demonstrate the strength of HSBC Malta’s business model and capital position. He noted the bank remains positive on the Maltese economy despite global uncertainty.

“We achieved strong results with profit before tax of €58.7m reflecting the strength of our business despite lower interest rates,” he said. “We continue to invest in technology, people and customer service while promoting our services through ongoing marketing efforts.”

The interim dividend of 10 cents per share will be paid on 23 September 2025 to shareholders on the register as at 20 August.

You Might Also Like

Latest Article

HSBC Malta Launches 2026 Campaign With Wealth, Lending And Insurance Offers

HSBC Bank Malta has launched its 2026 Start of Year Campaign, introducing a coordinated set of offers across wealth management, personal lending and insurance aimed at delivering added value to customers during the first months of the year. Running until 30 April 2026, the campaign is designed to support customers’ financial planning and protection needs … Continued

|

4 February 2026

Written by MeetInc.

Anton Buttigieg Appointed Senior Advisor At Nasdaq-Listed Trust Stamp

|

4 February 2026

Written by MeetInc.

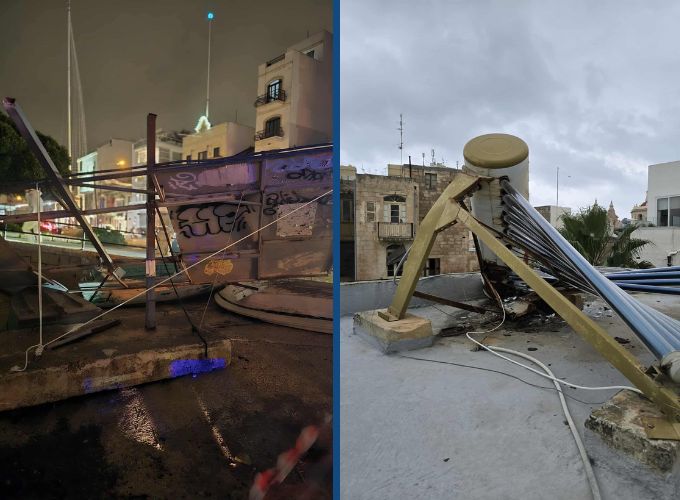

Storm Reconstruction Funds Should Exclude Illegal Structures, Says Malta Chamber

|

4 February 2026

Written by MeetInc.