Patrick Debattista

After a 10% drop in one trading week, the S&P 500 officially entered correction territory.

Understandably, many investors are asking: How long will it take to bounce back?

While recent memory might suggest quick rebounds—especially after COVID-19—historical data tells a different story: recoveries tend to be slow, uneven, and emotionally draining.

The market did stage a partial rebound following former President Trump’s surprise announcement of a temporary 90-day pause on proposed tariffs. The move was seen as a de-escalation, and markets responded swiftly. But whether this rebound holds remains to be seen—particularly if he reverses course again once the 90 days expire.

How Long Do Recoveries Actually Take?

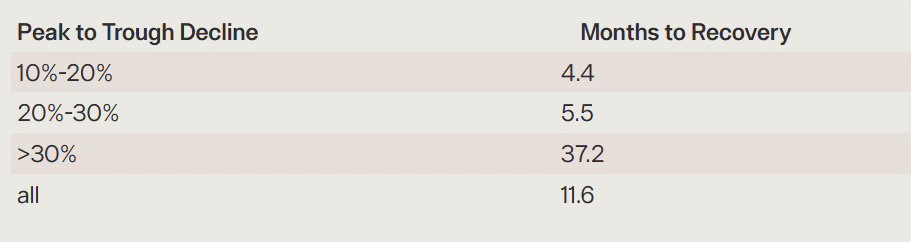

The relationship between drawdown depth and recovery time is clear: the deeper the fall, the longer it usually takes to recover.

But that recovery doesn’t happen in a smooth, predictable way.

This is how long it usually takes for markets to climb back after various levels of decline:

Past crashes show how long this can feel in real time.

For example, after both the 2000 dot com bubble and the 2008 global financial crisis, it took nearly six years for the S&P 500 to recover.

Investors often underestimate just how long they may need to stay invested before seeing full recovery—especially after larger drops.

Why Staying Invested Makes a Difference

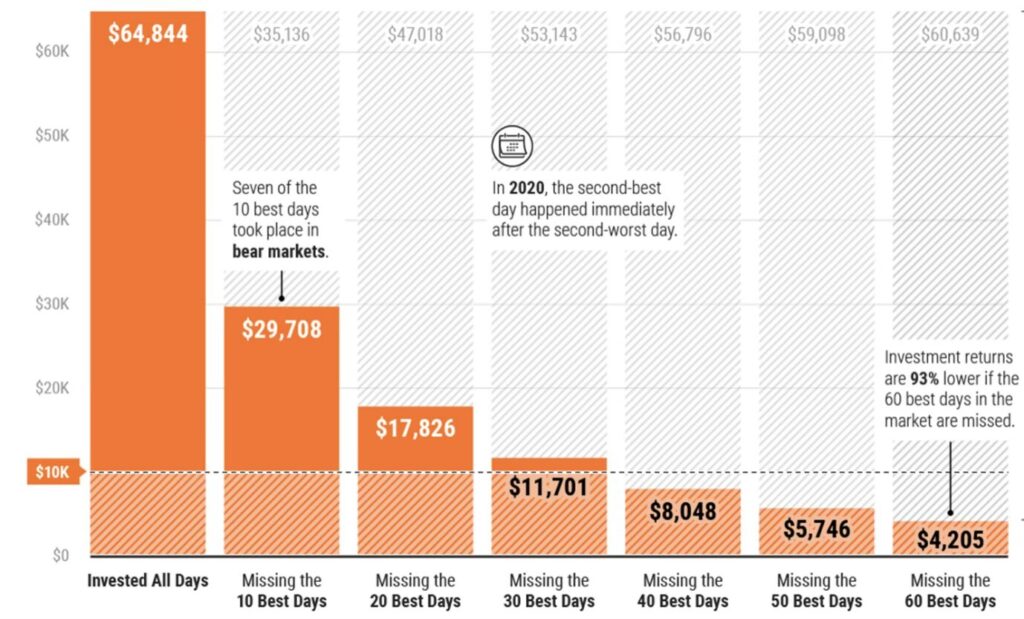

That brings us to the other side of the equation: what happens if you try to time the market?

During volatile periods, many investors reduce exposure to avoid further losses.

But this can backfire.

In fact, some of the best trading days happen during the worst downturns—when it feels most uncomfortable to stay invested.

Take a look at the 10 best trading days since 2008:

Seven of the best days occurred during the worst weeks of the 2008 crash and the 2020 COVID panic.

For example, the S&P 500 surged +11.6% on 13th October 2008 and +9.4% on 24th March 2020.

These rebounds are unpredictable and often happen while sentiment is still negative. Therefore, missing them can drastically reduce long-term performance.

In fact, being out of the market for just the 10 best days over a 20-year period would have cut your total returns by more than 50%.

Final Thoughts

While some declines last years, history shows that most developed equity markets eventually recover. Even Japan, which stayed below its peak for over three decades, reached new all-time highs in 2024.

But unlike past cycles, today’s volatility is being driven by unpredictable political moves. This makes it even harder to guess what happens next.

Having said that, recoveries often happen quietly, while investors are bracing for more pain. The evidence shows that missing even a handful of recovery days can do more damage than the downturn itself.

I understand – staying invested through downturns isn’t easy, but it remains one of the most effective strategies for long-term success.

As the old saying goes: this too shall pass.

You Might Also Like

Latest Article

Germany’s Unemployment Tops Three Million For First Time In A Decade

Unemployment in Germany has risen above three million for the first time in ten years, fuelling pressure on the government to deliver results from its massive investment programme. Figures released by the Federal Labour Office on Friday showed that 3.02 million people were unemployed in August in seasonally unadjusted terms, up by 46,000 from July. … Continued

|

29 August 2025

Written by Patrick Debattista

Malta’s Deficit Widens To €518 Million As Public Debt Tops €11.1 Billion

|

29 August 2025

Written by Patrick Debattista

Valentino Architects Win International Award For Gozo Restoration Project

|

29 August 2025

Written by Patrick Debattista