CrediaBank has entered into a wide-ranging strategic partnership with global payments company Euronet Worldwide Inc, a move that could have significant implications for Malta’s payments and digital banking landscape in the coming years.

Announced at the end of December, the agreement sees Euronet acquire CrediaBank’s merchant acquiring business and ATM network in Greece, while also becoming a long-term strategic partner providing core payment services to the bank. The partnership includes plans to launch a modern, account-to-account digital wallet, expand card issuing and acquiring capabilities, and introduce additional value-added payment services.

The deal is notable from a Maltese perspective given CrediaBank’s confirmed acquisition of a majority stake in HSBC Malta, subject to regulatory approval. While the Euronet partnership currently applies only to CrediaBank’s Greek operations, Euronet already has an established presence in Malta, where it has operated since 2016 and manages the country’s largest independent ATM network.

Under the agreement, CrediaBank’s merchant portfolio will be merged with Euronet’s existing acquiring business, creating a combined platform expected to process more than $22 billion in transactions annually and serve over 240,000 merchants. The partnership also establishes a long-term collaboration to expand merchant services and roll out advanced payment solutions across multiple sectors.

Euronet will additionally provide issuing services for debit, credit and prepaid cards, covering processing, personalisation, lifecycle management and back-office support. This structure allows CrediaBank to retain customer ownership and commercial control while benefiting from Euronet’s scalable infrastructure.

A central pillar of the agreement is the development of a new consumer digital wallet built on Euronet’s payments platform. The wallet will integrate instant account-to-account payments with loyalty programmes and other value-added services, aligning with Europe’s accelerating shift toward cardless and real-time payment models.

Although Malta is not included at this stage, the partnership establishes a framework that could be extended beyond Greece. For Malta — where SMEs, tourism, retail and services dominate economic activity — such a model could enhance payment acceptance, speed up merchant onboarding, improve pricing transparency and support omnichannel commerce across physical and digital environments.

The ATM component is also relevant locally. Under the Greek agreement, Euronet will manage CrediaBank’s ATM network while ensuring nationwide service continuity. In Malta, Euronet already operates around 200 ATMs, and a similar participation model could significantly expand customer access points following the HSBC Malta transaction.

You Might Also Like

Latest Article

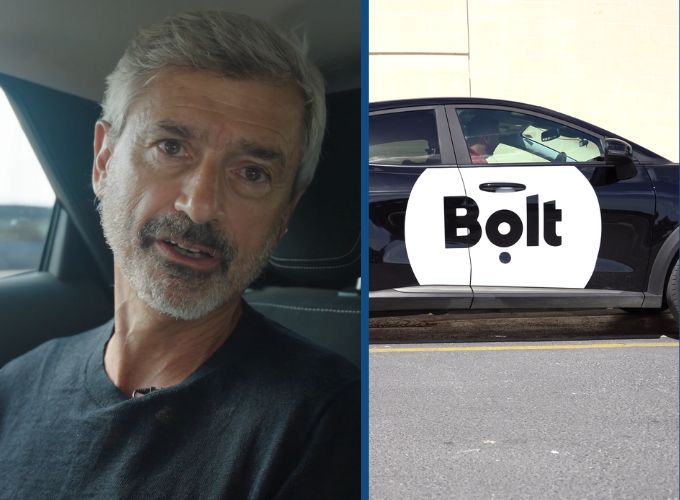

In The Driver’s Seat With Joseph Sultana: From A Maltese Shopfront To A Multi-Million Global Exit

Some entrepreneurial journeys are defined by flash moments of inspiration. Others are shaped, patiently and relentlessly, by lived experience. The story of Ascent Software, and of its co-founder Joseph, belongs firmly in the latter camp. The inaugural episode of In the Driver’s Seat, a new MeetInc series launched in collaboration with Bolt Malta, takes viewers … Continued

|

19 January 2026

Written by MeetInc.

Global Payments Partnership Positions CrediaBank For Post-HSBC Malta Transformation

|

19 January 2026

Written by MeetInc.

Zanzibar Moves Ahead With Dunia Cyber City and Virtual Residency Programme

|

19 January 2026

Written by MeetInc.